So, when you have been to prepay six months of lease, you’d record it as an expense when you made the upfront fee. Paying upfront for expenses similar to lease, insurance, and subscriptions might help with budgeting and planning. You know you may have the money at present, and it helps you lock in a lower cost.

Insurance Coverage As A Prepaid Expense

- It often follows a set pattern that helps tell the complete story of your business’s funds.

- By implementing these practices and sustaining vigilant oversight of advance payments, businesses can improve their monetary efficiency and effectiveness.

- To compute the month-to-month prepaid expense amount, divide the entire quantity paid for the products by the number of months over which the benefit might be consumed.

- On the other hand, liabilities, equity, and income are increased by credits and decreased by debits.

- Its advanced options help scale back handbook errors, improve accuracy, and improve total efficiency.

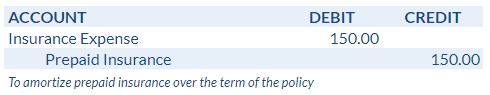

When an expense is paid prematurely, it is recorded as an asset and progressively expensed because the service is used. A prepaid expense means that you’re paying the complete quantity for a product or service you haven’t obtained yet. This process would proceed month-to-month, lowering the prepaid software program asset by $10,000 each time and recognizing it as an expense, until the full $120,000 has been expensed over the 12 months. Many forms of bills should be purchased for a 12 months, or a quantity of years, in advance. Favorable phrases are often provided in return for the commitment to longer-term contract and the short-term cash flow impression of the higher initial outlay. For a complete view of how these entries come collectively, an amortization schedule is shown beneath outlining how the prepaid asset balance is reduced, or amortized, throughout the time period of the coverage.

In order that will assist you advance your profession, CFI has compiled many resources https://www.intuit-payroll.org/ to help you alongside the path.

Prepaid Insurance Example Journal Entry

As a seasoned monetary professional with over 20 years of experience, I focus on strategic financial management and steering for growing businesses. My experience is rooted in my CPA, and CGMA credentials, and an academic background that includes an MBA and an MS in Strategic Administration. Let’s say your organization purchases an annual subscription to a cloud-based accounting software program on January 1, 2024, for $6,000. Every month, as you occupy the office house, you will convert 1/12th of the pay as you go hire into an precise expense. Trendy companies often prepay for software to lock in present pricing and avoid monthly billing hassles. Prepaid insurance typically presents the biggest reductions for annual funds.

What Is The Journal Entry For Pay As You Go Expenses?

However, as the services and products are acquired, prepaid bills are acknowledged on the revenue assertion for every interval when the money is spent. Pay As You Go expenses appear as current assets as a result of they symbolize future value you have already paid for, like prepaid lease or prepaid insurance coverage. Accrued bills seem as present liabilities as a end result of they characterize cash you owe for advantages already received, corresponding to utilities used but not yet billed or worker wages earned but not yet paid. Additional prepaid bills can embody software program licenses, upkeep contracts, and professional memberships. To create your first journal entry for pay as you go expenses, debit your Prepaid Expense account.

Numeric unveils a new model centered on information movement, mirroring the strategy to accounting as a knowledge drawback. Intrigued by the thought, Lucy decides to put money into an annual subscription. CitrusOne is a venture-backed vertical SaaS product tailor-made particularly for lemonade stands. HashMicro is Singapore’s ERP resolution supplier with the most full software program suite for various industries, customizable to unique needs of any enterprise. Study what they’re and the way to correctly price range fixed and variable expenses.

Each month, you may acknowledge $100 in insurance coverage expenses until the pay as you go insurance coverage account is totally amortized. Beyond frequent cases like liability insurance and workplace leases, companies encounter all kinds of different pay as you go bills. Accounting for prepaid bills is an easy course of, but it requires cautious consideration to detail to remain compliant with accounting requirements. Follow these finest practices to keep your books audit-ready and achieve a true picture of your company’s monetary place. If so, these kind of prepaid bills require special attention in your books. One of essentially the most time-consuming elements of managing pay as you go bills is monitoring and amortizing the payments over time.

Common examples of prepaid bills embrace rent, insurance coverage premiums, subscriptions, and service contracts. For instance, if an organization pays a full year’s lease upfront, the amount is recorded as a prepaid expense and allocated monthly as an precise expense. Prepaid expenses are payments made for goods or services you’ll use in future accounting periods. Unlike regular bills (which hit your books the moment you utilize them), prepaid expenses are recorded as property because they symbolize future value. Understand what prepaid bills are and why they are classified as assets. Amortization is the systematic allocation of a pay as you go expense over its useful life.

This rise highlights the rising want for strategic advisory services that go beyond standard bookkeeping. Assets and expenses are elevated by debits and decreased by credit. Under is a break down of topic weightings in the FMVA® financial analyst program. As you’ll be able to see there’s a heavy concentrate on monetary modeling, finance, Excel, enterprise valuation, budgeting/forecasting, PowerPoint presentations, accounting and business strategy. A journal company receives $1,200 from a customer for a 12-month subscription in January. We mentioned that so as to convert an asset into an expense you need to estimate how a lot that asset depreciates over time.

Subsequently underneath the accrual accounting mannequin an entity only recognizes an expense on the earnings assertion as soon as the great or service bought has been delivered or used. Prior to consumption of the good or service, the entity has an asset because they exchanged cash for the proper to a great or service at a while sooner or later. The advance purchase is recognized as a prepaid asset on the steadiness sheet. Pay As You Go bills, or Pay As You Go Property as they’re generally referred to in general accounting, are recognized on the steadiness sheet as an asset. A “prepaid asset” is the result of a prepaid expense being recorded on the stability sheet.

Additional you might also file TDS returns, generate Form-16, use our Tax Calculator software, claim HRA, examine refund status and generate hire receipts for Earnings Tax Filing. Want to study extra about the different sorts of accounts that come in useful for today’s small business? By the end of 1 year subscription, the complete $12,000 shall be expensed, and the Pay As You Go Bills account will be decreased to $0. As the campaign progresses, $2,500 ($15,000 ÷ 6) is recognized as an promoting expense every month. The world accounting providers industry is predicted to broaden at a CAGR of 6.2%, reaching $735 billion by 2025.