Likewise, compounding increases the amount https://www.simple-accounting.org/ of total curiosity you’ll owe on a mortgage. Reinvested dividends and interest improve your principal, so future earnings are calculated on a bigger base. Over many years, this “growth on growth” effect can make a major difference in retirement balances or faculty financial savings accounts. When you borrow money, the interest rate determines how a lot the loan will price you. Debtors need lower rates, whereas buyers favor greater ones for higher returns.

Consequently, understanding these differences is crucial when making funding selections. The time factor plays an important function in determining potential growth. Figuring Out the difference between simple and compound interest may help you select a mortgage or savings choice that fits your overall funds. Debtors often prefer easy curiosity to keep away from greater prices, whereas traders benefit from compound curiosity that grows their cash faster over time. Curiosity charges can appear intimidating, however understanding them is essential for managing your funds, whether or not you are saving money or borrowing it.

Let’s learn to calculate compound interest as repeated simple interest. It is charged interest on both the principal and the accrued curiosity. T is the number of years 4000 is invested and it is equal to 4 in this case. Subsequently, a saver or investor ought to gain more cash with compound curiosity than easy curiosity. Whether Or Not simple curiosity is better than compound interest is dependent upon whether you’re a borrower or a saver and investor.

This means the interest earned or paid remains fixed over time. It Is generally used for short-term loans, like automotive loans or private loans, and is easy to calculate. Simple interest is preferred by borrowers and barely paid to traders. Compound interest is a boon for traders and a major monetary burden for these in debt.

Compound Interest Calculation Examples

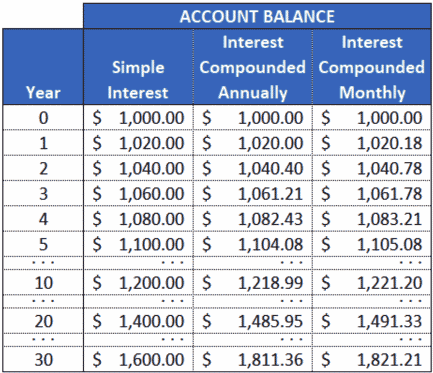

Customers should contemplate lenders and accounts that pay out curiosity more incessantly as this may help them experience greater monetary progress because the curiosity compounds sooner. If the interest is paid out much less regularly (quarterly or annually), it is attainable the account holder wouldn’t experience as fast of growth. Compound interest may help you decide up momentum as you’re employed toward your monetary targets. When your earnings are reinvested and allowed to grow, you would earn extra money than if you merely let your earnings sit in a savings account. Some financial savings accounts—as well as certificates of deposit (CDs) and a few loans—use easy interest.

- Given its predictability, debtors appreciate its simplicity, making it a common choice for short-term loans.

- The compounding frequency is the variety of occasions per given unit of time the amassed interest is capitalized, frequently.

- With compound interest, the added interest accrues to the principal, resulting in more substantial growth.

For that purpose, it is essential to reap the advantages of compound interest when you can. If you might have any questions on how curiosity suits into your monetary technique, attain out to a monetary advisor at present. Another disadvantage of compound interest is that it may be complicated compared with simple interest.

Comparing Monetary Products

The compound effect that helps investments grow works against debtors, making debt more and more costly over time. Simple curiosity is primarily utilized in sure kinds of short-term loans, some authorities bonds, and fundamental monetary calculations the place simplicity is most well-liked over precision. Most real-world monetary products use compound interest as a outcome of it extra precisely reflects the time value of cash and offers honest compensation for using funds over prolonged periods. The difference between easy and compound curiosity represents one of the most elementary concepts in finance and arithmetic. Whereas both calculate the price of borrowing cash or the return on investments, they work in dramatically other ways that can result in vastly completely different outcomes over time. Understanding this distinction is essential for making knowledgeable financial decisions all through your life.

Compound interest is extensively utilized in monetary merchandise corresponding to financial savings accounts, mutual funds, and credit card debt. It advantages investors by maximising returns but can burden debtors when utilized to loans with frequent compounding intervals. Understanding the difference between simple and compound curiosity is fundamental to monetary literacy. This information influences each financial choice you make, from selecting savings accounts to understanding loan phrases to planning for retirement. The exponential nature of compound interest signifies that early understanding and action can have profound impacts on your financial future.

Continuous Compounding

All buying and selling and investing comes with threat, including but not restricted to the potential to lose your entire invested quantity. This approach leads to USD 750 in curiosity over three years, with no further expenses for amassed interest. Debtors benefit from this simplicity, because it avoids curiosity compounding on unpaid amounts. Interest is added again to the principal, resulting in compound progress. Lower curiosity earned compared to compound interest over the same interval. One Other advantage of compound curiosity is that it could act as a cushion towards inflation.

By working by way of scenarios, mastery of those ideas turns into achievable. For occasion, a loan of 10,000 ZAR at a simple rate of interest of 5% over two years will yield an easy curiosity of 1,000 ZAR. The financial landscape can be advanced, but understanding these primary ideas can simplify decision-making. Armed with the best info, you can navigate loans and financial savings with confidence, making certain higher administration of your funds. Working with an adviser could come with potential downsides, corresponding to payment of fees (which will scale back returns). There are not any ensures that working with an adviser will yield positive returns.

Compound interest drives wealth creation by reinvesting earnings, allowing investors to create exponential development over the lengthy term. Traders planning for long-term or major financial milestones can leverage compound curiosity to improve portfolio worth considerably. Interest can be compounded on varied schedules, corresponding to yearly, semi-annually, quarterly, month-to-month, or even daily. The extra regularly interest is compounded, the higher the total quantity will grow as interest is added extra usually to the balance. Simple curiosity is calculated solely on the original principal amount, resulting in fixed, predictable progress. In distinction, compound curiosity includes both the principal and amassed curiosity from earlier intervals, creating exponential progress.