The formulation is used to create the financial statements, and the method should stay in balance. Your income account tracks all the earnings your corporation earns. Asset accounts track every thing your corporation owns that has value, from physical gadgets to intangible property. These are often classified; for instance, present belongings are gadgets an organization expects to convert to money within one year. Debits and credit type the foundation of double entry bookkeeping.

Conversely, when one thing is subtracted from an asset account, it will lower the debit facet. For instance, when receiving money, it’ll document as a debit to the money account. Income accounts are necessary in accounting as a result of they report all of the cash that comes into a enterprise. The Cash account shops all transactions that contain money receipts and money disbursements.

Debits And Credit Cheat Sheet: A Helpful Beginner’s Information

Generally, this kind of accounting incorporates most well-liked or retained stock, treasury stock, and other complete earnings (OCI). Nonetheless, debits and credit act totally in a special way on this account, based on https://www.simple-accounting.org/ the character of the transactions. Using the same business, let’s assume, Viva Electronics has paid its electricity invoice cost $80,000 by transferring cash using net banking. Due To This Fact, the amount spent is increasing the company’s expenses, so the entries shall be posted under the debit column.

How Accounts Are Affected By Debits And Credit

The Source of monetary benefit is credited and the destination account is debited. The concept of debit and credit score is much of curiosity to an accounting scholar as it’s the base for total commerce examine. The debit entry will increase the whole liabilities of the corporate and reduces the entire assets of the company.

Accounts such as Money, Funding Securities, and Loans Receivable are reported as assets on the bank’s stability sheet. Customers’ financial institution accounts are reported as liabilities and include the balances in its customers’ checking and financial savings accounts in addition to certificates of deposit. In effect, your bank statement is just one of thousands of subsidiary information that account for tens of millions of dollars that a bank owes to its depositors. If you would possibly be new to the research of debits and credit in accounting, this may appear puzzling.

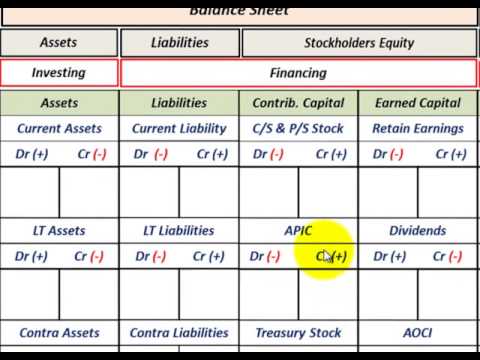

This system differs from single-entry bookkeeping, a kind of accounting practice that solely provides one optimistic or unfavorable worth per monetary transaction. In accounting, property, liabilities, and equity are the three important elements of the steadiness sheet. The distinction between debits and credit lies in how they have an effect on your numerous enterprise accounts.

This transaction would contain debiting the vehicle account, reflecting a rise in property, whereas crediting the money account, indicating a decrease in money. Another sensible example is the funding of capital by an proprietor into the enterprise, the place you would debit the cash account and credit the owner’s capital account in equity. A legal responsibility account on the books of an organization receiving money in advance of delivering goods or providers to the customer.

An equity account is a type of economic account that may either be a debit or credit account. Asset accounts represent the sources of a business, similar to money, accounts receivable, inventory, workplace tools, and automobiles. Accounts could be classified as either property or liabilities, and every account could have a debit or credit score balance. The credit score entry is made to a different account, such because the cash account.

Double Entry Bookkeeping

- Understanding debit vs credit accounting is crucial for correct bookkeeping.

- Liabilities and equity are on the right facet of the balance sheet formula, and these accounts are elevated with a credit score entry.

- This is why most trendy accounting software will only allow you to submit the entry if the debits and credits do stability.

- The easiest approach to remember the knowledge in the chart is to memorise when a particular kind of account is elevated.

- This system differs from single-entry bookkeeping, a sort of accounting practice that solely adds one constructive or negative value per financial transaction.

A present asset account that reviews the quantity of future hire expense that was paid in advance of the rental period. The quantity reported on the steadiness sheet is the amount that has not yet been used or expired as of the balance sheet date. This is a non-operating or “other” item resulting from the sale of an asset (other than inventory) for more than the quantity proven in the company’s accounting data. The gain is the difference between the proceeds from the sale and the carrying amount proven on the company’s books.

One popular mnemonic to remember is “DEALER,” where Debit increases in Bills, Property, and Losses, and Credit Score will increase in Equity, Revenue, and Positive Aspects. This phrase enshrines the fundamental principle that belongings and expenses are increased on the debit facet, and liabilities and revenues are increased on the credit side. Included are the income assertion accounts (revenues, bills, gains, losses), summary accounts (such as earnings summary), and a sole proprietor’s drawing account.