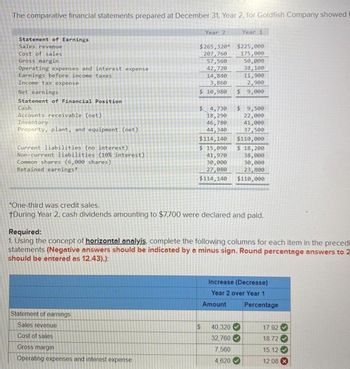

For instance, they will present how different businesses working in the same industry react to market conditions. Including prior interval figures, full with percentage changes, helps to eliminate this downside. The Securities and Exchange Commission requires that a publicly held firm use comparative financial statements when reporting to the public on the Type 10-K and Kind 10-Q. By setting up the pyramid of ratios, you’ll gain a particularly stable understanding of the business and its monetary statements.

Buyers in the UAE’s diverse financial markets rely on comparative monetary statements to evaluate an organization’s monetary stability and progress potential. These statements provide insights into a company’s historical efficiency, aiding investors in making knowledgeable choices about investments. By utilizing comparative monetary statements, the company assesses the impact of revolutionary product launches and market tendencies on its financial results. This strategic evaluation guides future investments and operational choices to maintain financial health within the dynamic UAE enterprise environment. Creating comparative monetary statements can be a complex process that requires consideration to detail and a thorough understanding of accounting principles. To keep away from frequent mistakes, it’s important to use constant accounting methods, ensure accuracy and consistency of data, modify for inflation, exclude non-recurring items, and provide context.

Can Comparative Financial Statements Be Used For Choice Making?

By analyzing financial statements, companies can determine areas the place they may be exposed to dangers corresponding to liquidity danger, credit score risk, and market threat. This information can be utilized to develop risk management methods and make sure that the enterprise is satisfactorily prepared for any potential risks. For instance, if a business has a excessive level of debt, monetary evaluation may help identify potential liquidity risks and assist the business develop a plan to handle these risks. It will adequately disclose all of the gadgets for inner or exterior evaluation with the peer group in share type. The earnings assertion might contemplate the bottom degree of web gross sales, and the money move statement can rely upon the base stage of total cash flows. Therefore, choosing the appropriate tools from the out there alternate options is an important aspect of the analytical task.

By reviewing financial statements over different intervals, they’ll determine how trends develop. When you compare a company’s balance sheet or income assertion over completely different intervals, you get a greater concept of its monetary well being. In the dynamic enterprise panorama of the UAE, where financial circumstances evolve, corporations use comparative monetary statements to inform strategic planning. Understanding how financial metrics change over time is instrumental in adapting business strategies for sustained success. In basic, horizontal analysis is extra helpful when evaluating the company’s performance in opposition to its opponents or identifying vital changes in the firm’s financial efficiency.

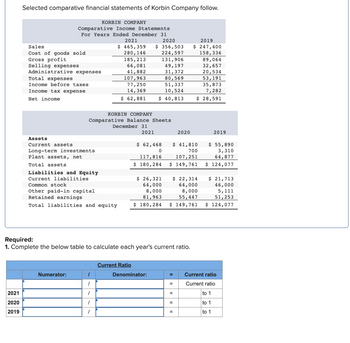

Balance Sheets

By doing this, we are ready to see how much of the company’s revenue is attributable to each category. If we see that the price of items sold is 60% of whole revenue, we will infer that the corporate has a high value construction. Alternatively, if we see that promoting and administrative expenses are only 10% of whole revenue, we can infer that the corporate has a low overhead value. Comparative statements can be used to match totally different companies, assuming that they comply with the identical accounting ideas.

What Data Do Comparative Monetary Statements Provide?

Money circulate statements provide a clear snapshot of how money is flowing out and in of your corporation, giving you priceless insights into the liquidity and monetary health of your operations. By analyzing these statements, you’ll be able to conduct a cash circulate evaluation to find out where https://www.simple-accounting.org/ your business stands financially. Whereas comparative financial statements supply many advantages, it could be very important perceive their limitations.

Comparative monetary statements are a vital device for understanding a company’s financial well being. By evaluating financial knowledge from different intervals or categories, buyers, analysts, and managers can identify trends and patterns in a company’s financial structure. Whether utilizing horizontal evaluation, vertical evaluation, or comparative stability sheets, the objective is to gain a deeper understanding of an organization’s monetary state of affairs and make informed choices.

The stock turnover ratio and the accounts receivable turnover ratio are two commonly used effectivity ratios. The stock turnover ratio measures what quantity of times an organization sells and replaces its inventory in a given period. The accounts receivable turnover ratio measures how rapidly an organization collects funds from its prospects. A higher ratio signifies that a company is managing its accounts receivable efficiently.

- This evaluation helps you understand how your small business is growing or declining and enables you to make informed selections for future progress strategies.

- By reviewing monetary statements over totally different periods, they will identify how developments develop.

- Once you have gathered and adjusted the monetary data, it’s time to analyze the data and identify trends.

- By using each strategies, you’ll find a way to acquire a comprehensive understanding of the company’s financial well being and make knowledgeable decisions about its future.

- In today’s aggressive world, it’s of utmost significance to comply with the group’s performance and the competitor, as it’s going to help maintain and thrive the performance of the business.

They assist identify tendencies in financial efficiency, such as a rise or decrease in revenue, bills, or profits. They also assist identify areas of power or weakness in a company’s monetary efficiency, similar to excessive or low revenue margins, high or low debt levels, or excessive or low liquidity. This info can be utilized to make knowledgeable decisions about the way ahead for the enterprise, similar to whether or not to increase or contract operations, invest in new services or products, or search extra funding. Comparative monetary statements provide a complete overview of your company’s financial health by comparing knowledge from totally different intervals. By analyzing these statements, you possibly can identify trends, evaluate the effectiveness of your methods, and make knowledgeable decisions to enhance your backside line. By comparing monetary statements for different intervals, stakeholders can identify developments, changes, and enhancements or declines in the company’s financial efficiency.

Comparative steadiness sheets are usually required under each GAAP and IFRS, which name for no much less than one prior period’s stability sheet to be introduced alongside the current period. Public corporations usually embrace two years of balance sheet data in their annual reports for consistency and transparency. This requirement helps users analyze trends and evaluate modifications in monetary position over time.

In this part, we are going to explore the various sorts of comparative financial statements in additional element. When it comes to making informed enterprise choices, having a clear understanding of an organization’s monetary health is essential. Comparative financial statements are a strong software that can assist business house owners and investors acquire this understanding. By comparing monetary statements from different time durations, stakeholders can identify trends and patterns that can inform future decisions. In this part, we are going to explore how comparative monetary statements can be used for choice making and provide insights from totally different views. General, preparing comparative financial statements requires careful attention to detail and an intensive understanding of accounting rules.